SES to bulk up defence work with rival’s capture

Luxembourg satellite giant grabs Grand Duchy-based Intelsat in €2.8 billion takeover

Luxembourg will become the centre of a military and government data behemoth if home-grown satellite giant SES swallows Grand Duchy-headquartered rival Intelsat as planned in a €2.8 billion takeover announced on Tuesday.

The combined company will more than double its revenues, employees and debt load if it clears regulatory hurdles in the US and Europe by the deal’s target closing late next year.

The new SES expects it will pare back its debts after 2026 to be again within the range required for its shares to be held by pension funds and other institutional investors, SES CEO Adel Al-Saleh said in a conference call on Tuesday.

The buyout was approved by the Luxembourg government, which along with two state-owned banks is the largest SES shareholder at 33%, Al-Saleh said.

The simplicity of a 100% buyout was key to reaching the deal after merger talks failed last year, with Al-Saleh suggesting the previous effort broke down over who would run the combined company and from where.

SES, Intelsat revive deal talks to form satellite giant

SES was in advanced talks last year to combine with Intelsat, which is also headquartered in Luxembourg but operated from the US. An agreement was hampered by Intelsat still reorganising after emerging from bankruptcy in 2022, Al-Saleh said.

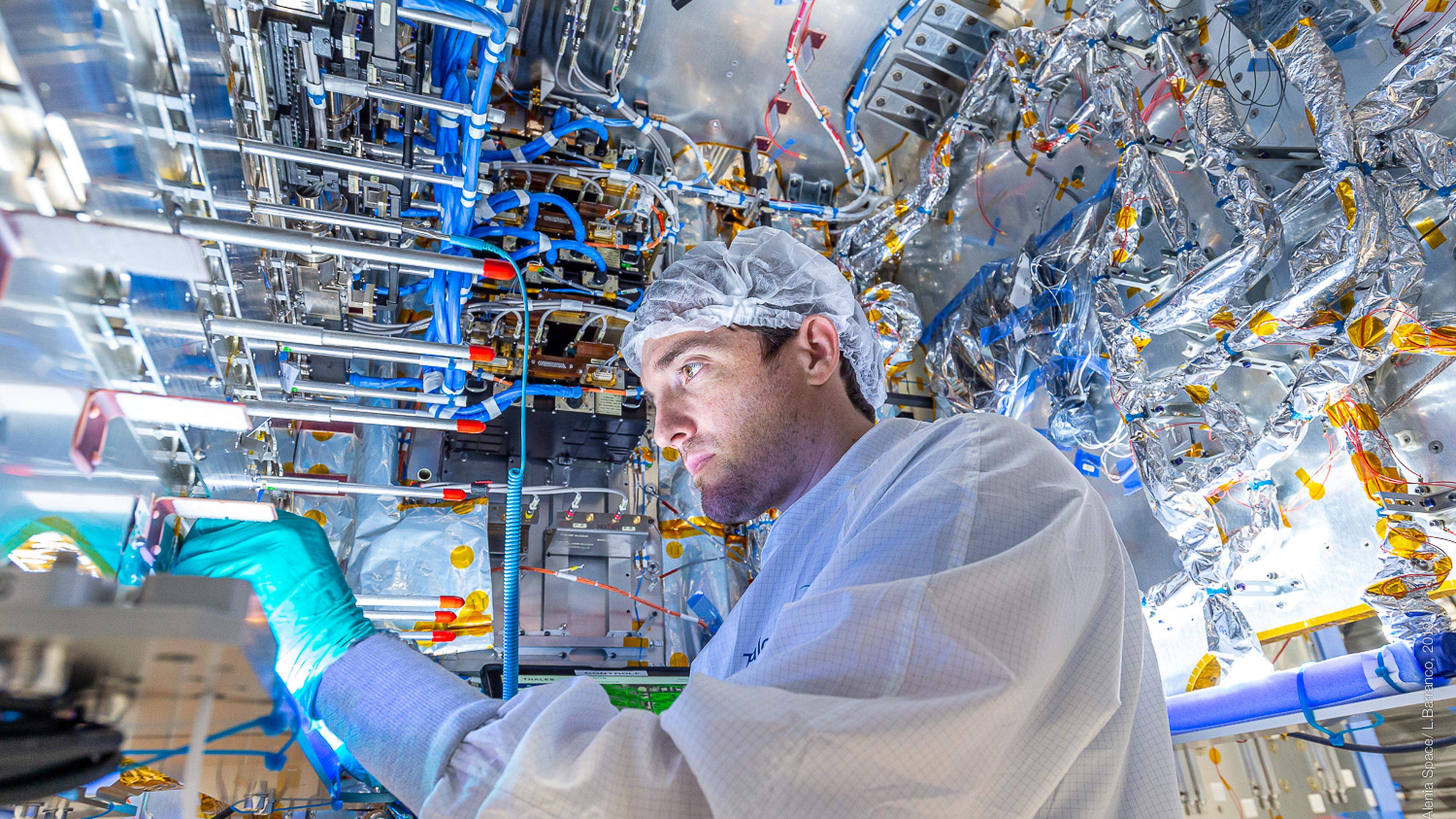

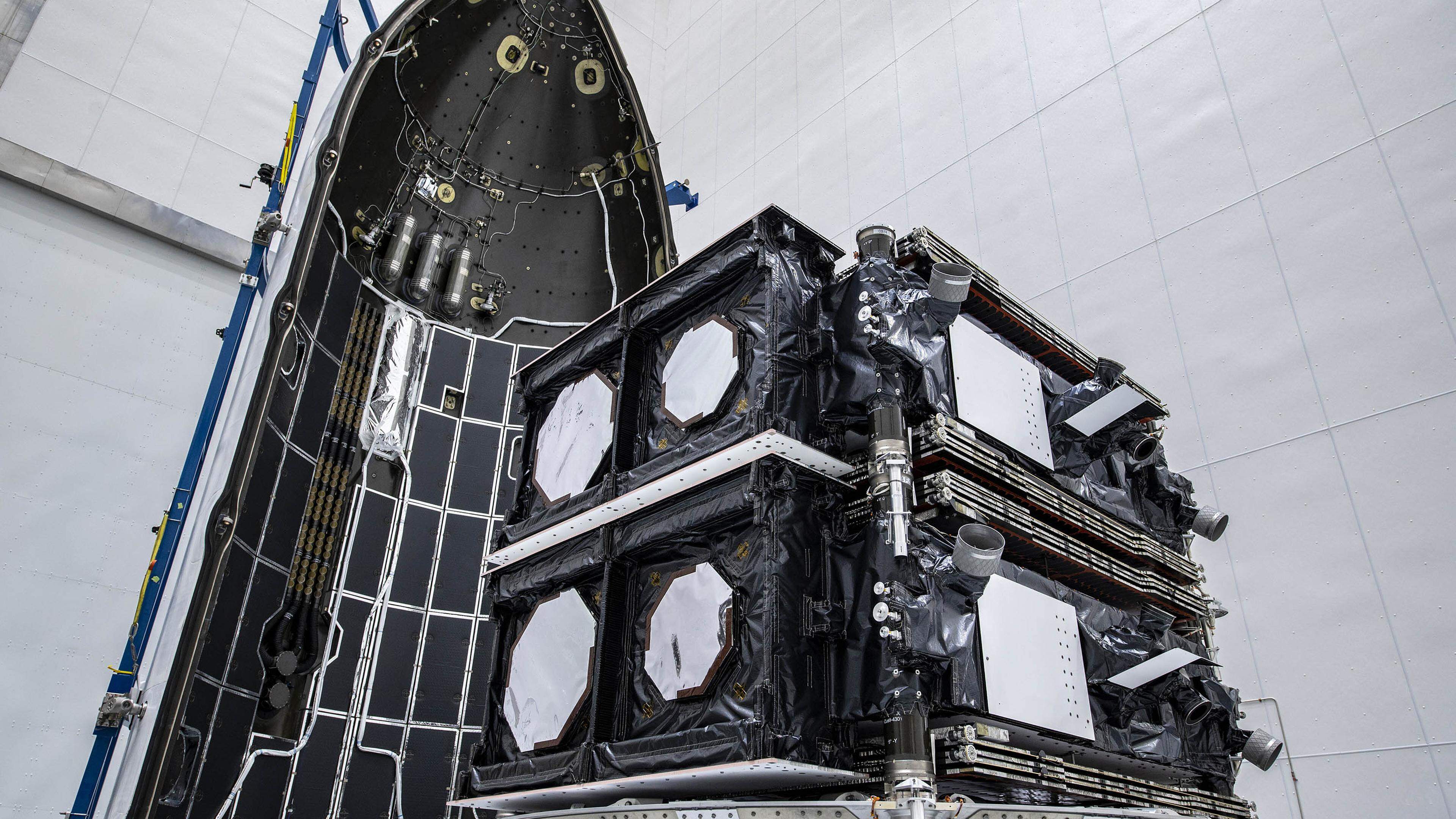

What is clear is that the new company’s more than 100 satellites in fixed orbits and further 26 spacecraft in lower, faster-responding tracks - together reaching 99% of the Earth’s surface - aim to compete more effectively for government contracts with Elon Musk’s Starlink network and other lower-cost competitors.

Al-Saleh estimated that the US government represented about half the €800 million in revenue SES collected last year from government customers around the world, a segment the combined company expects will grow at 7% a year to €13 billion and by far its biggest segment by 2030.

“Satellite communications is continuing to be very strategic for governments across the world,” Al-Saleh said. “So having sovereign capabilities is very critical for the success of any company that wants to operate, because it is one of the largest segments of opportunities for satellite operators across the world.”

“The combined company will be a very large provider for very important customers around the world, whether it’s European governments, the US, UK, Nato and UN requirements,” he said.

Luxembourg money launches satellites to avoid collisions in the cosmos

The SES segment that serves governments as well as cruise ships at sea, jets in flight and remote destinations across the globe saw revenues climb 10% during the first three months of this year compared to the same period last year, the company said on Tuesday.

Broadcast revenue declining

Its foundational business from its inception in 1985 - transmitting video for broadcast networks - fell by an additional 5% during the first quarter, when revenues hit nearly €500 million for a 2.5% increase, the company said.

Broadcasters now make up less than half of SES’s revenues and the money is expected to keep dropping by 5% a year, the company said.

Prime Minister Luc Frieden during a press briefing on Tuesday said that the satellite sector is dynamic and underground profound change. “Standing still would have been too risky for SES and a step backwards,” said Frieden, citing changing consumer habits - such as a shift from broadcast to data transmission - and rising competition.

“The government is happy that SES is taking the active role here and wasn’t acquired itself by another company. It is important to us that SES remains Luxembourgish,” Frieden said, adding that the company’s headquarters would remain in Luxembourg.

Intelsat employed about 2,000 staff worldwide and increased its employment in the Grand Duchy to around 50 in 2022, a company spokeswoman said then. It was founded 60 years ago as a public-private consortium by the telecommunication agencies of the US and more than a dozen other countries.

SES, based in Betzdorf, employed 680 people in Luxembourg at the start of 2023, the latest date for which government figures are available.

SES may make some number of those workers around the world redundant, while cutting back on the number of satellites and other competitive costs the two companies would have committed independently, Al-Saleh said.

We just don’t need to spend as much money as we were spending separately

“We both have very large terrestrial networks supporting our teleports and gateways using almost overlapping capabilities, that there’s a clear synergy there,” he said. “But also it’s about optimising the future multi-orbit satellite investments and fleets. We just don’t need to spend as much money as we were spending separately. The combination would give us an opportunity to reduce that.”

Merger hunt

SES had been on the hunt for a merger target earlier this year as it decided how best to deploy €2.5 billion in US payments, Al-Saleh said in February after just weeks in his job. The money came after SES successfully launched new satellites and released previous parts of the electromagnetic spectrum so it can be used for 5G broadband services in America.

After cutting debt by €1 billion and rewarding shareholders with a share buyback and extra dividend payment, “this particular transaction, if we’re able to successfully close it with the right type of value, is the most compelling proposition that we have on the table, Al-Saleh said.

SES, Intelsat revive deal talks to form satellite giant

SES had been in advanced talks last year to combine with Intelsat, which is also headquartered in Luxembourg but operated from the US, to create a European satellite giant that can better compete with billionaire Elon Musk.

Those discussions ended without a deal months later. Intelsat pulled out of the talks after differences with SES over business priorities, US television network outlet CNBC reported.

(This story was updated on 30 April 2024 at 15:08 to include graphic showing share ownership in SES.)